The world of mortgages can often feel overwhelming, but with the right tools, it becomes a manageable journey. Our latest offering, the Mortgage Payment Calculator for Excel, is designed to be your reliable companion in this process. This innovative tool promises not only to simplify your mortgage calculations but also to provide a clearer understanding of your financial commitments.

Table of Contents

- Introduction

- Key Features of the Mortgage Payment Calculator for Excel

- How to Use the Mortgage Payment Calculator for Excel

- Interpreting Your Results

- Download Free Mortgage Payment Calculator for Excel

- Summary

Introduction

In today’s dynamic real estate market, having a dependable mortgage calculator spreadsheet at your fingertips empowers you to make informed decisions. It’s not just about figuring out your monthly payments; it’s about understanding how your mortgage works and how different variables affect your financial outlook.

Our Mortgage Payment Calculator for Excel is meticulously designed to give you this insight, ensuring that you navigate your mortgage journey with confidence and clarity.

Key Features of the Mortgage Payment Calculator for Excel

When it comes to managing your mortgage, having the right tool can make all the difference. Our Mortgage Payment Calculator for Excel is not just any tool—it’s a comprehensive solution designed to make mortgage planning straightforward and intuitive. Here are some key features that set it apart:

- User-Friendly and Intuitive Interface: The calculator is designed for ease of use. Whether you’re a first-time homebuyer or a seasoned property investor, you’ll find the interface welcoming and straightforward, allowing you to input and adjust data effortlessly.

- Full Error Handling for Accurate Calculation: To enhance reliability and user confidence, the tool is equipped with comprehensive error handling features. This means that if an input is missing or incorrect, the calculator promptly notifies you with clear, helpful messages, guiding you towards accurate and meaningful outputs.

- Fully Customizable Parameters: Tailor the calculator to your specific needs. Adjust key variables like the loan amount, interest rate, loan term, number of payments per year, and the loan start date. This flexibility ensures that the tool adapts to your unique financial situation.

- Additional Payment Option with Savings Analysis: Plan for the future by exploring the impact of extra monthly payments. Our tool not only allows for this option but also calculates the total savings you’ll accrue over the loan’s lifespan, providing a clear picture of how additional payments can benefit you financially.

- Multi-Currency Functionality: Whether you’re in Alabama, Zagreb, or anywhere in between, our calculator speaks your currency. Easily switch between USD, GBP, and EUR, making it a versatile tool for a global audience.

- Visual Representations for Better Understanding: A picture is worth a thousand words, especially when it comes to understanding your mortgage. Our tool includes a dynamic chart showing the balance over the life of the loan and a pie chart detailing the split between principal and interest payments, offering you a visual grasp of where your money is going.

- Detailed Amortization Schedule: Get an in-depth view of your payment plan with a comprehensive amortization schedule. The tool provides a scrollable snapshot of monthly payments and the option to delve into the full schedule, ensuring you have all the details at your fingertips.

In conclusion, the Mortgage Payment Calculator for Excel is more than just a calculator; it’s a holistic tool designed to bring clarity and control to your mortgage planning.

How to Use the Mortgage Payment Calculator for Excel

Getting started with the Mortgage Payment Calculator for Excel is a straightforward process; let’s walk through the simple steps to efficiently utilize this powerful tool for your mortgage planning needs.

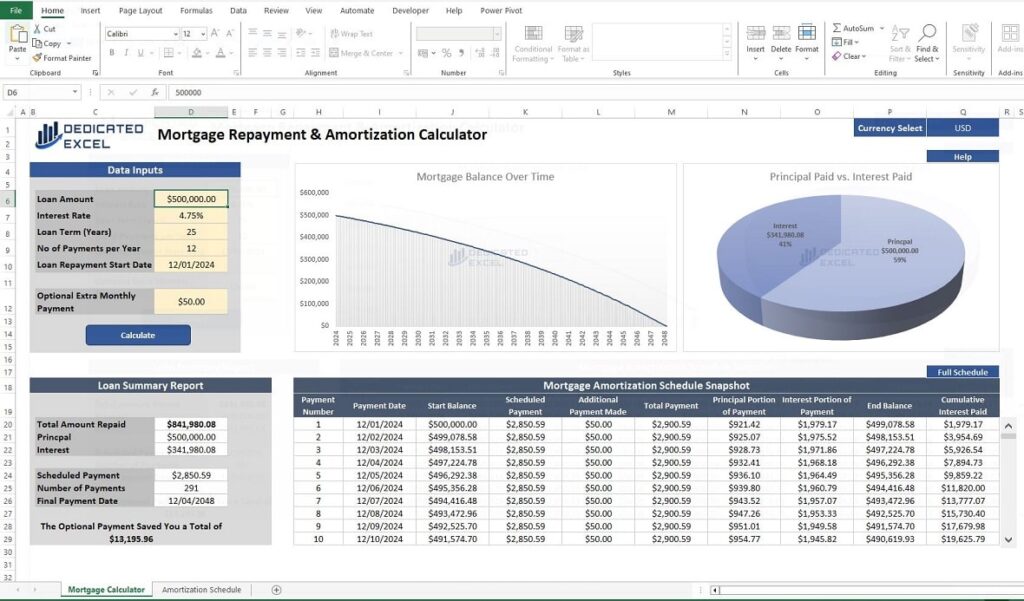

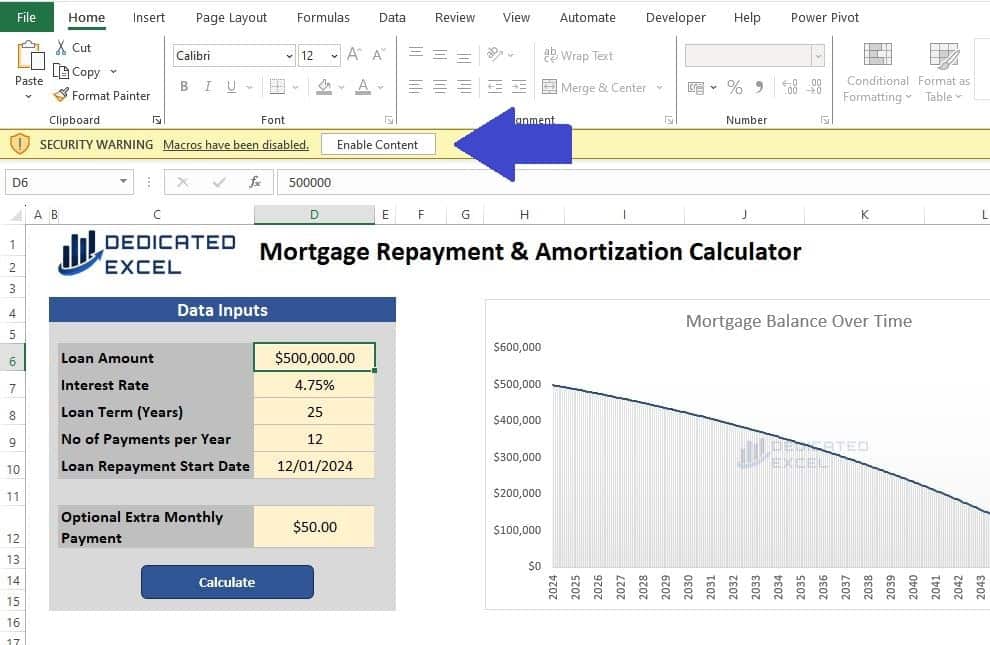

1. Open and Enable Macros

Open the downloaded Excel file and if prompted click ‘Enable Content‘ to ensure the tool can update correctly.

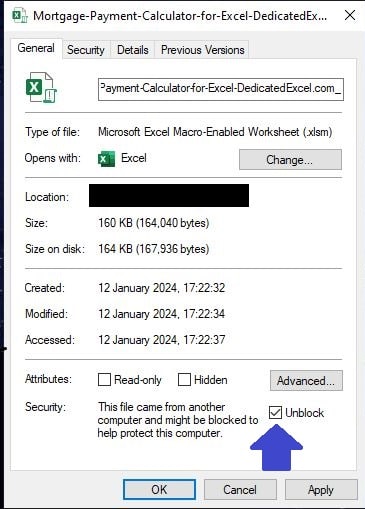

Note that depending on your Excel security settings you may need to unblock the file after downloading it and before opening it. If you can’t get Macros to enable then right-click on the downloaded file and select ‘Properties‘ then check “Unblock” in the Security section. Then open the file and try again.

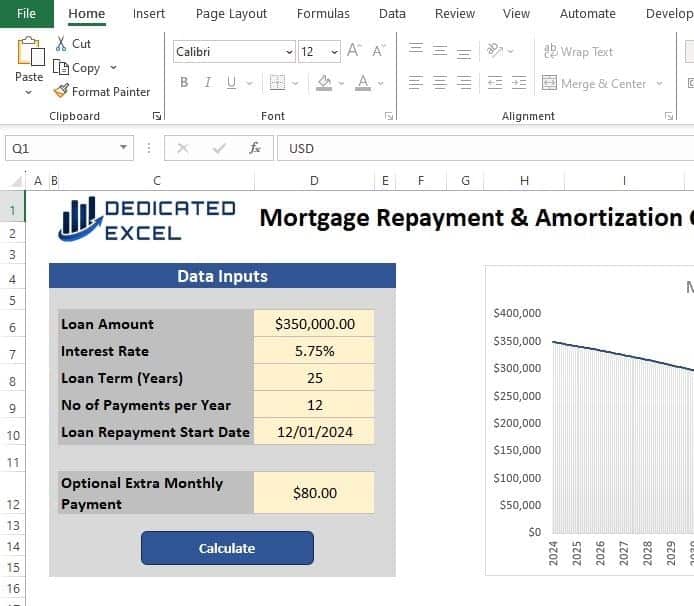

2. Complete Data Input Fields and Calculate

Our Mortgage Payment Calculator for Excel is equipped with six adjustable input fields, each designed to cater to the different aspects of your mortgage calculation.

- Loan Amount: This is where you enter the total amount of the loan you’re taking out for your property. Whether it’s a modest abode or your dream home, input the full loan amount here to start your calculations.

- Interest Rate: In this field, enter the annual interest rate of your mortgage. The calculator is equipped to handle various interest rate formats, ensuring accurate calculations whether your rate is fixed, variable, or adjustable.

- Loan Term (Years): Specify the duration of your loan in years. Whether it’s a standard 30-year mortgage or a shorter-term loan, this field helps in calculating the number of total payments and the duration of your financial commitment.

- No of Payments per Year: Mortgages often have different payment plans. Enter how many payments you’ll make in a year – monthly (12), bi-monthly (24), or any other arrangement you have with your lender.

- Loan Repayment Start Date: Choose the date when you’ll start repaying the loan. This information is crucial for scheduling your payments and understanding when your loan will be fully paid off.

- Optional Extra Monthly Payment: Plan ahead for any additional monthly payments you intend to make. This is a powerful feature for those looking to pay off their mortgage early and save on interest. The tool calculates the impact of these extra payments on the overall loan term and the interest saved.

Once you’ve filled in all the fields, click the ‘Calculate‘ button. This is where the magic happens! The calculator processes your inputs and refreshes all the stats, providing you with up-to-date information on your mortgage plan.

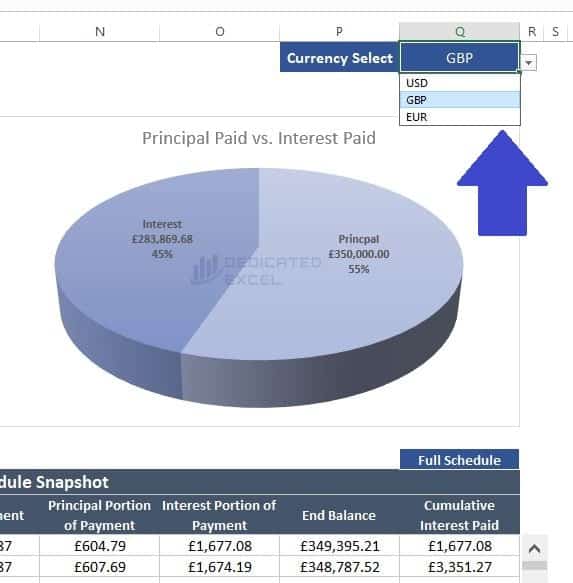

3. Currency Selection

To switch between the currency options change the drop down in Cell Q1 to either USD, GBP or EUR and the worksheet will update automatically:

Interpreting Your Results

Once you’ve entered your details into the Excel Mortgage Payment Calculator, it unveils a wealth of information tailored to your specific mortgage scenario, providing key insights to help you navigate your financial journey with confidence.

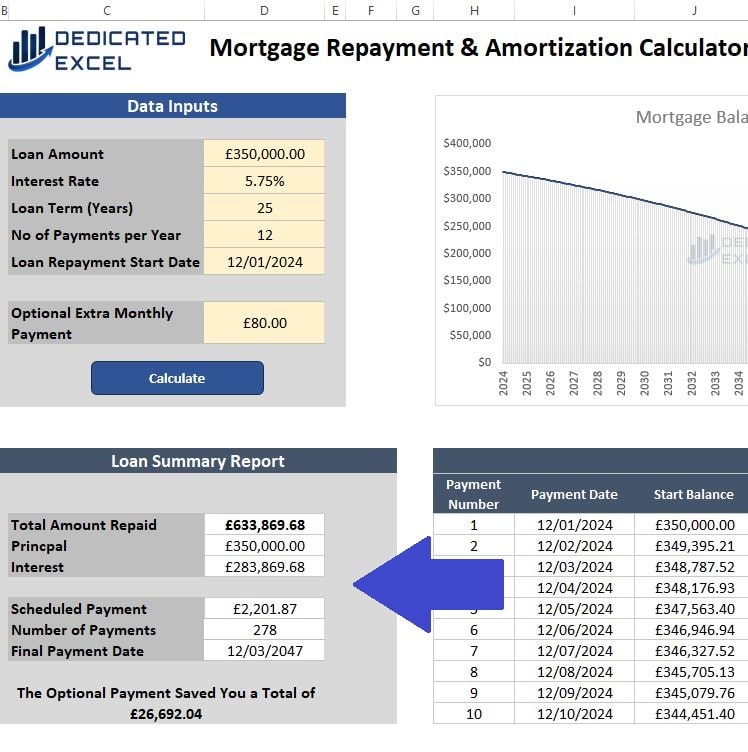

Loan Summary Report

The Loan Summary Report from our Mortgage Payment Calculator for Excel provides a comprehensive overview of your mortgage details. Here’s a summary of the report based on your specific inputs:

- Total Amount Repaid: The report indicates that the total amount repaid over the life of the loan amounts to £633,869.68. This figure represents the cumulative sum of all payments made towards the mortgage.

- Principal Amount: The principal, which is the original loan amount borrowed, stands at £350,000. This is the core amount on which interest calculations are based.

- Interest Paid: Over the course of the mortgage, the total interest paid sums up to £283,869.68. This figure illustrates the cost of borrowing the principal amount.

- Scheduled Payment: Each scheduled payment for this mortgage is £2,201.87. This consistent payment amount is calculated to cover both principal and interest, ensuring the loan is paid off by the end of the term.

- Number of Payments: The total number of payments scheduled for this mortgage is 278. This figure reflects the frequency and duration of payments required to fulfil the mortgage agreement.

- Final Payment Date: The mortgage is projected to be fully paid off by 12th March 2047. This date marks the end of your mortgage term and the point at which the property will be entirely yours.

- Savings from Optional Extra Monthly Payment: By making additional monthly payments, a significant saving of £26,692.04 has been achieved over the life of the loan. This demonstrates the financial benefit and interest savings that can be realized through extra payments.

The Loan Summary Report is an invaluable tool in understanding the long-term implications and benefits of your mortgage plan, especially when considering additional payments. It provides a clear and concise breakdown of your mortgage, empowering you with the knowledge to make informed financial decisions.

Visual Reporting

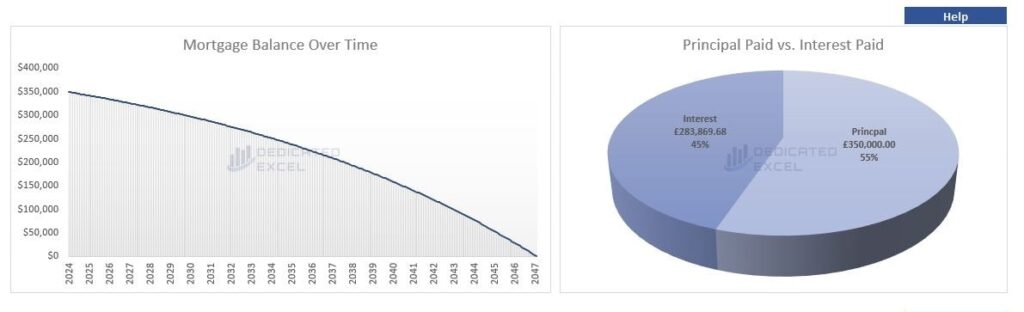

In addition to the detailed numerical data, our Mortgage Payment Calculator for Excel provides powerful visual reporting tools to help you better understand your mortgage over time. These visual elements transform complex data into easily digestible charts, making it simpler to grasp the nuances of your mortgage plan. Here’s an overview of the two key visual reporting elements:

Mortgage Balance Line Chart

- This dynamic line chart visually represents the balance of your mortgage over time.

- As you progress through your loan term, the chart shows the decreasing balance of your mortgage, offering a clear visual representation of how each payment reduces the principal.

- The descending line effectively illustrates the journey towards becoming mortgage-free, allowing you to track your progress at a glance.

- This visual tool is especially helpful in understanding the long-term trajectory of your mortgage balance and the impact of additional payments or changes in terms.

Principal and Interest Pie Chart

- The pie chart provides an insightful breakdown of your total mortgage payments, clearly differentiating between the principal and interest components.

- It offers a visual comparison of how much of your payment is allocated towards reducing the principal versus covering the interest.

- This chart is particularly useful for understanding the proportion of interest in the early stages of the mortgage compared to the principal, which usually takes up a larger share in later stages.

- By clearly depicting the ratio of principal to interest, this chart aids in comprehending the true cost of borrowing and how your payments are structured over the life of the loan.

Both these charts serve as powerful visual aids, simplifying the complexities of mortgage calculations and providing a more intuitive understanding of your financial obligations. Whether you are evaluating different mortgage options or strategizing early repayments, these visual reporting elements offer a clear and immediate picture of the financial implications, enhancing your ability to make informed decisions.

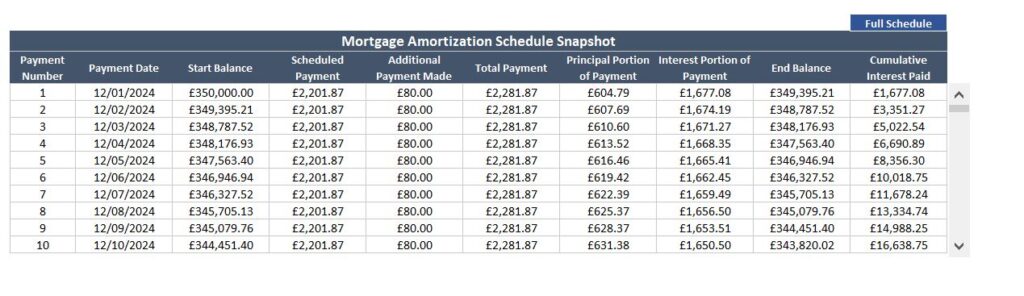

Mortgage Amortization Schedule

The Mortgage Payment Calculator for Excel comes equipped with a detailed Amortization Schedule, a critical feature for anyone looking to understand the specifics of their mortgage payments over time. This schedule offers an in-depth look at each payment throughout the life of the loan. Here’s what the Amortization Schedule includes and how you can interact with it:

Key Fields of the Amortization Schedule:

- Payment Number: Tracks the sequence of payments from the first to the last.

- Payment Date: Indicates the due date for each mortgage payment.

- Start Balance: Shows the outstanding loan balance at the beginning of each period.

- Scheduled Payment: The regular payment amount due, based on the loan terms.

- Additional Payment Made: Displays any extra payments made, reflecting efforts to pay off the loan more quickly.

- Total Payment: The total amount paid in that period, including both scheduled and additional payments.

- Principal Portion of Payment: The part of the payment that reduces the principal balance.

- Interest Portion of Payment: The amount of the payment that goes towards interest.

- End Balance: The remaining balance on the loan after the payment.

- Cumulative Interest Paid: The total interest paid over the course of the loan up to that payment.

Within the main tool, users can view a snapshot of the first 10 transactions. This snapshot provides a quick overview of the recent or upcoming payments. A scroll bar adjacent to this snapshot allows users to seamlessly scroll through all the payments, offering a comprehensive look at the entire payment schedule without overwhelming the user with information.

For those who need to see every detail at once, the “Full Schedule” button is a game changer. Clicking this button switches the view to the “Amortization Schedule” worksheet, displaying the entire table with all rows visible at once.

The full schedule view is particularly useful for those who wish to analyse their entire payment trajectory, plan for future payments, or need a detailed breakdown for financial planning or consultations. It provides clarity, transparency, and control, allowing users to stay informed and make strategic decisions about their mortgage payments.

Download the Mortgage Payment Calculator for Excel

You can download your FREE copy of the Dedicated Excel Mortgage Payment Calculator here:

Download the Free Mortgage Payment Calculator for ExcelSummary

In summary, the Mortgage Payment Calculator for Excel is more than just a tool; it’s your personal guide through the complex world of mortgage planning. With its user-friendly interface, comprehensive visual reports, detailed amortization schedule, and the flexibility to adjust to various currencies, this calculator is designed to simplify what can often be an overwhelming process. Whether you’re a first-time buyer, a homeowner considering refinancing, or an investor analysing potential properties, this tool offers the clarity and precision you need.

By providing clear insights into your mortgage payments, interest implications, and the potential savings from extra payments, the calculator empowers you to make informed decisions. The visual charts and amortization schedule offer a deeper understanding of how your payments impact your loan over time, demystifying the often complex dynamics of mortgage repayments.

We encourage you to leverage this tool to plan, analyse, and strategize your mortgage approach. Remember, effective mortgage management is a key step towards financial stability and achieving your long-term property goals. With the Mortgage Payment Calculator for Excel, you’re equipped not just to plan but to plan smartly.

Keep Excelling,

While the Mortgage Payment Calculator for Excel helps you manage your mortgage efficiently, why not also explore smart saving strategies for your home? Check out our Excel Dollar Cost Averaging Calculator – an essential tool for building your savings systematically and making your dream home a reality.